When a brand-name drug loses its patent, it doesn’t just get replaced-it gets overwhelmed. Dozens, sometimes hundreds, of companies jump in to make the exact same medicine. And that’s when prices start to plummet. It’s not magic. It’s basic economics: more sellers = lower prices. This isn’t theory. It’s happening right now in pharmacies across the U.S., saving billions every year.

Why More Generic Manufacturers Mean Lower Prices

Let’s say you take a common drug like metformin for diabetes. A few years ago, it was only made by one company and cost $150 a month. Then five other manufacturers got approval to make it. Prices dropped to $30. Then eight more joined. Now? You can get a 90-day supply for under $10 at some pharmacies. That’s not a sale. That’s competition in action.

Studies show the pattern clearly. The first generic version cuts the price by about 17%. Add a second manufacturer? It drops another 22%. By the time you have four or more makers, the price is down 70% or more from the original brand. A 2021 study in JAMA Network Open tracked 50 drugs and found that with ten or more generic makers, prices fell to 70-80% below what the brand charged. That’s not a rumor. That’s data from Medicare spending records between 2015 and 2019.

The FDA confirms this. Their 2024 report on 742 newly approved generic drugs estimated those alone saved the system $14.5 billion in one year. And over the past decade, generics saved the U.S. healthcare system more than $1.7 trillion. That’s not a drop in the bucket-it’s a flood.

It’s Not Just About Quantity-It’s About Who’s Making It

But here’s the catch: not all generics are created equal. The biggest price drops happen with small-molecule pills you swallow-like antibiotics, blood pressure meds, or cholesterol drugs. These are easy to copy. So manufacturers flood in. But for complex drugs-like injectables, biologics, or biosimilars-there are far fewer competitors. Why? Because they’re harder and more expensive to make. The result? Prices don’t fall nearly as much.

Take insulin or cancer drugs that come in vials. Even when biosimilars enter the market, prices often stay high. The same 2021 study found that if biosimilars were treated like regular generics under Medicare, spending on those drugs could’ve dropped nearly 27%. But because there are only one or two makers, there’s no real pressure to cut prices.

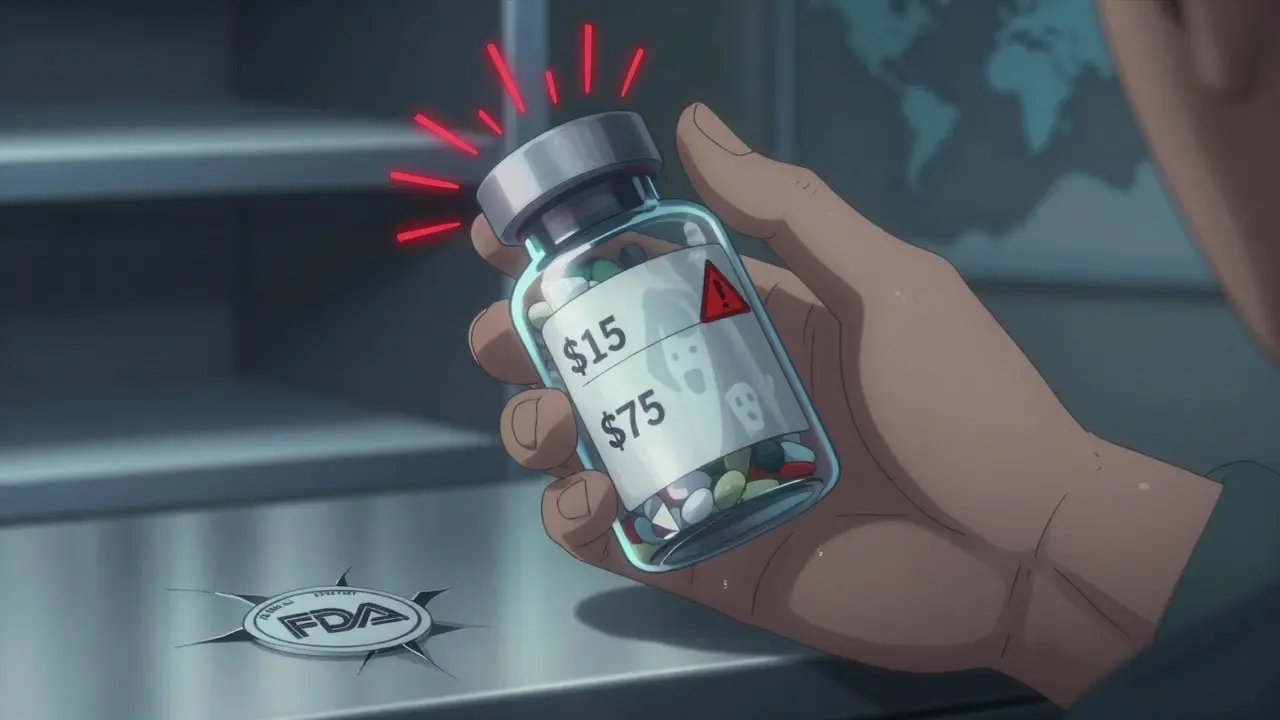

And it gets worse. In some cases, a drug might have only one or two manufacturers left. If one of them shuts down production-due to low profits, quality issues, or supply chain problems-the price can spike overnight. There are real stories: patients on epilepsy meds like levetiracetam saw prices jump 300-500% after manufacturers exited the market. One pharmacy on Reddit reported a $15 pill suddenly costing $75. That’s not a glitch. That’s a market failure.

Who’s Making These Generics? And Why Does It Matter?

Most generic drugs aren’t made by big pharma companies. They’re made by smaller firms-often based overseas or in places like India and China. A 2017 study found that over half of all generic drugs have at most two manufacturers. Forty percent have just one. That’s not competition. That’s a monopoly in disguise.

Why? Because the profit margins are thin. A generic drug maker might earn just $800,000 a year per product after costs. That’s not enough to invest in new equipment, quality control, or R&D. So when a company can’t make money on a drug, they quit. And when they quit, the remaining makers raise prices. It’s a vicious cycle.

Big mergers have made it worse. Between 2014 and 2016, nearly 100 generic manufacturers were bought out or merged. The Federal Trade Commission has started blocking some of these deals because they reduce competition. But many slip through. The result? Fewer players. Less pressure to lower prices. And more risk of shortages.

How Patients Actually Benefit-and Where They Get Hurt

For most people, generics are a lifeline. A 90-day supply of lisinopril for high blood pressure? $4. Atorvastatin? $5. Metformin? Under $10. These aren’t discounts. These are prices so low they’re almost free. GoodRx and other price-comparison tools show that when eight or more makers compete, prices stay stable for years.

But patients don’t always know which version they’re getting. Pharmacists can switch between generics without telling you-unless your drug has a narrow therapeutic index (like warfarin or thyroid meds). That means even small differences in how the drug is absorbed can matter. The FDA’s Orange Book lists which generics are truly interchangeable (rated AB). But most patients don’t check it. And many doctors don’t either.

And then there’s the supply chain. If a plant in India fails an FDA inspection, it can cause nationwide shortages. In 2022, a shortage of a common antibiotic led to prices jumping 200% in some areas. That’s not because of inflation. It’s because there was only one backup manufacturer-and they couldn’t keep up.

What’s Being Done to Fix It?

The FDA launched its Drug Competition Action Plan in 2017 to speed up approvals and block anti-competitive behavior. The CREATES Act of 2019 was designed to stop brand-name companies from blocking generic makers from getting samples needed for testing. These are real tools. But enforcement is slow.

Pharmacy Benefit Managers (PBMs)-the middlemen who negotiate drug prices for insurers-are now buying in bulk. That’s helped keep some prices low, even when manufacturers consolidate. But it’s not a long-term fix. PBMs profit from price differences, not lower prices overall. So their incentives aren’t always aligned with patients.

The real solution? More manufacturers. More transparency. And more accountability. The FDA needs to approve generics faster. Regulators need to block mergers that reduce competition. And patients need to know: if your drug has only one or two makers, you’re one recall away from a price disaster.

What You Can Do Right Now

You don’t need to wait for policy changes to save money. Here’s how to protect yourself:

- Use GoodRx or SingleCare to compare prices across pharmacies. Prices can vary by hundreds of dollars for the same generic.

- Ask your pharmacist: “How many manufacturers make this drug?” If the answer is one or two, ask your doctor about alternatives.

- Check the FDA’s Orange Book for therapeutic equivalence codes. Look for “AB” ratings-those are interchangeable.

- If your price suddenly jumps, call your pharmacy. Ask if they switched manufacturers. If so, request the previous version.

- For chronic meds, consider a 90-day supply. It’s often cheaper and gives you time to react if prices change.

Generic drugs are one of the most powerful cost-savers in modern medicine. But they only work when competition is healthy. When there are too few makers, the system breaks. And when it breaks, patients pay the price-in dollars, in stress, and sometimes in health.

Why do generic drug prices drop so much when more companies start making them?

When multiple manufacturers make the same generic drug, they compete on price because the product is identical. The first generic usually cuts the price by 17%. With two competitors, it drops another 22%. By the time four or more are making it, prices are often 70% or more below the brand-name version. This happens because each company tries to win market share by offering the lowest price, and since production costs are similar, price becomes the main differentiator.

Are all generic drugs the same as the brand name?

Yes, by law. The FDA requires generic drugs to have the same active ingredient, strength, dosage form, and route of administration as the brand. They must also be bioequivalent-meaning they work the same way in the body. The only differences can be in inactive ingredients like fillers or dyes, which don’t affect how the drug works. The FDA rates generics with an “AB” code to show they’re interchangeable with the brand.

Why do some generic drugs suddenly get much more expensive?

When a drug has only one or two manufacturers and one shuts down production-due to quality issues, low profit margins, or supply chain problems-the remaining maker has little competition. That’s when prices spike. For example, if a drug used to have five makers and now only has one, prices can jump 300-500%. This is common with older, low-cost generics where profit margins are razor-thin.

Do generic drug manufacturers make lower-quality drugs?

No. The FDA holds generic manufacturers to the same quality standards as brand-name companies. All facilities are inspected regularly, and the active ingredients must be identical. However, when profit margins are too low, some manufacturers may cut corners on packaging, testing, or staffing-which can lead to shortages or recalls. It’s not about quality of the drug itself, but about the stability of the supply chain under extreme price pressure.

What’s the difference between a generic and a biosimilar?

Generics are exact copies of small-molecule drugs made with chemical synthesis. Biosimilars are highly similar versions of complex biological drugs made from living cells. Because biological drugs are harder to replicate, biosimilars aren’t exact copies, and they face fewer competitors. As a result, biosimilars don’t drive down prices as much as generics do. For example, while a generic statin might have 10+ makers, a biosimilar insulin might have only one or two.

Can I ask my pharmacist to switch me to a cheaper generic version?

Yes, in most cases. All 50 states allow pharmacists to substitute a generic for a brand-name drug unless the doctor specifically says “dispense as written.” You can also ask your pharmacist to switch between different generic manufacturers if one becomes more expensive. Just make sure your drug isn’t one with a narrow therapeutic index-like warfarin or lithium-where even small changes can affect how it works.

10 Comments

Jodi Olson February 1, 2026 AT 02:46

Competition isn't just economic theory-it's survival. When you have ten companies fighting over a $10 pill, nobody can afford to be lazy. The market forces precision, consistency, and efficiency. What's terrifying is how fragile this system is. One factory shutdown, one regulatory hiccup, and suddenly your life-saving medication becomes a luxury. We treat drugs like commodities, but they're not. They're oxygen for millions.

Rob Webber February 2, 2026 AT 18:59

This whole system is rigged. Big Pharma doesn't care about generics-they own the patents, they own the regulators, and they own the PBMs. The moment a drug goes generic, they just shift focus to the next billion-dollar biologic. Meanwhile, you're stuck choosing between your rent and your insulin because some Indian plant got shut down for a missing logbook. This isn't capitalism. It's feudalism with pill bottles.

Lisa McCluskey February 3, 2026 AT 04:27

For most people, generics are the only reason they can afford to stay alive. I've seen patients who skip doses because they can't afford the brand. Then the generic comes in-$4 for a month's supply-and everything changes. But the real issue isn't the price drop-it's the instability. One manufacturer leaves, prices triple, and no one notices until someone dies. We need better monitoring, not just more approvals.

Melissa Cogswell February 4, 2026 AT 11:30

It's funny how we celebrate generics as a win until they disappear. The FDA approves hundreds a year, but we never track how many get abandoned because the profit margin is $0.02 per pill. When you're making $800k a year on a drug that costs $2 to produce, you're not building a business-you're running a charity. And charities don't last.

Holly Robin February 4, 2026 AT 12:29

THEY KNOW. They ALL know. The FDA, the PBMs, the pharmacies-they let this happen on purpose. Why? Because when prices drop too low, people stop trusting the medicine. And if people stop trusting, they go back to the brand. And the brand? It's still sitting there, waiting to charge $500 again next year. This isn't a market failure. It's a psychological trap. They want you scared enough to pay more.

Shubham Dixit February 4, 2026 AT 13:47

India makes 40% of the world's generics and still we act like we're surprised when things go wrong. We outsource our healthcare to cheap labor and then cry when the supply chain breaks. We don't invest in our own production because it's easier to blame foreigners. But here's the truth: if India stops exporting, America stops breathing. We built this fragile house on sand and now we're mad the tide came in.

KATHRYN JOHNSON February 6, 2026 AT 08:33

Pharmacists should be required to disclose the number of manufacturers for every generic. Not optional. Not suggested. Mandatory. If a drug has one or two makers, the label should say: 'High risk of shortage. Price may spike without notice.' Patients deserve transparency, not silent substitutions.

Sazzy De February 8, 2026 AT 06:07

I used to panic every time my metformin changed shape. Then I learned to check the Orange Book. Now I just ask my pharmacist: 'How many makers?' If it's more than five, I don't worry. If it's one? I call my doctor. Simple. No drama. Just smart.

Blair Kelly February 8, 2026 AT 22:34

Let’s be real-no one in Congress gives a damn until someone dies. We have laws like the CREATES Act, but enforcement is a joke. Brand-name companies delay generics by blocking sample access-legally. The FDA takes years to approve a simple generic. Meanwhile, patients are rationing pills. This isn’t a healthcare crisis. It’s a moral failure dressed in bureaucracy.

Rohit Kumar February 9, 2026 AT 20:57

Generics are the quiet revolution of modern medicine. In India, we make them not because we’re cheap, but because we understand scale. A single plant can produce billions of pills for pennies. But here, you treat medicine like a luxury brand. You don’t need 10 manufacturers to make a pill. You need one good one-and then protect it. The real problem isn’t too many makers-it’s too little regulation to keep them alive.